HILTON REPORTS THIRD QUARTER RESULTS

Hilton Worldwide Holdings Inc. ("Hilton," "the Company," "we," "us" or "our") (NYSE: HLT) today reported its third quarter 2025 results.Catégorie : Monde Chiffres et études

Ceci est un communiqué de presse sélectionné par notre comité éditorial et publié gratuitement le 23-10-2025

|

Highlights include:

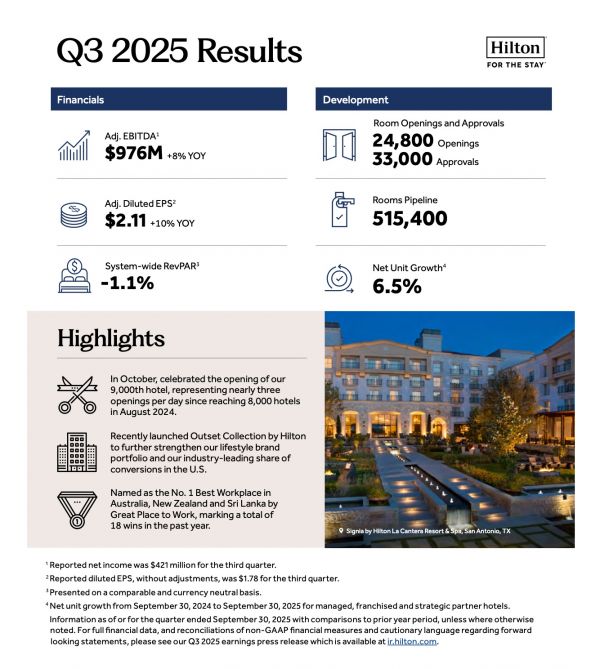

- Diluted EPS was $1.78 for the third quarter, and diluted EPS, adjusted for special items, was $2.11

- Net income was $421 million for the third quarter

- Adjusted EBITDA was $976 million for the third quarter

- System-wide comparable RevPAR declined 1.1 percent, on a currency neutral basis, for the third quarter compared to the same period in 2024

- Approved 33,000 new rooms for development during the third quarter, bringing our development pipeline to a record 515,400 rooms as of September 30, 2025, representing growth of 5 percent from September 30, 2024

- Added 24,800 rooms to our system, resulting in 23,200 net additional rooms for the third quarter, contributing to net unit growth of 6.5 percent from September 30, 2024

- Announced the launch of a new lifestyle brand, Outset Collection by Hilton, in October 2025

- In October 2025, reached our 9,000th property milestone with the opening of the Signia by Hilton La Cantera Resort and Spa

- Repurchased 2.8 million shares of Hilton common stock during the third quarter, bringing total capital return, including dividends, to $792 million for the quarter and $2,671 million year to date through October 2025

- Full year 2025 system-wide RevPAR is projected to be flat to an increase of 1.0 percent on a comparable and currency neutral basis compared to 2024; full year net income is projected to be between $1,604 million and $1,625 million; full year Adjusted EBITDA is projected to be between $3,685 million and $3,715 million

- Full year 2025 capital return is projected to be approximately $3.3 billion

Overview

Christopher J. Nassetta, President & Chief Executive Officer of Hilton, said, "Our third quarter results continued to demonstrate the resilience of our business model, delivering strong bottom line performance despite softer industry RevPAR. We remain optimistic, that in the U.S., lower interest rates, a more favorable regulatory environment, certainty on tax policy and a significant investment cycle will accelerate economic growth and travel demand, and, when paired with limited industry supply growth, should drive stronger RevPAR growth over the next several years. The quality of our development pipeline, acceleration in new development construction starts, attractiveness of our brands for conversions and continued growth of our brand presence globally gives us confidence in delivering net unit growth between 6.5 percent and 7.0 percent in 2025 and 6.0 percent to 7.0 percent over the next several years."

For the three months ended September 30, 2025, system-wide comparable RevPAR decreased 1.1 percent compared to the same period in 2024 due to modest occupancy and ADR declines. Management and franchise fee revenues increased 5.3 percent compared to the same period in 2024.

For the nine months ended September 30, 2025, system-wide comparable RevPAR increased 0.3 percent compared to the same period in 2024 due to an increase in ADR. Management and franchise fee revenues increased 6.1 percent compared to the same period in 2024.

For the three months ended September 30, 2025, diluted EPS was $1.78 and diluted EPS, adjusted for special items, was $2.11, compared to $1.38 and $1.92, respectively, for the three months ended September 30, 2024. Net income and Adjusted EBITDA were $421 million and $976 million, respectively, for the three months ended September 30, 2025, compared to $344 million and $904 million, respectively, for the three months ended September 30, 2024.

For the nine months ended September 30, 2025, diluted EPS was $4.84 and diluted EPS, adjusted for special items, was $6.03, compared to $4.09 and $5.36, respectively, for the nine months ended September 30, 2024. Net income and Adjusted EBITDA were $1,163 million and $2,779 million, respectively, for the nine months ended September 30, 2025, compared to $1,034 million and $2,571 million, respectively, for the nine months ended September 30, 2024.

Q3 2025 Results

|

|