|

ACCOR: FIRST-QUARTER 2023 REVENUE OF €1,139 MILLION UP 54% LIKE-FOR-LIKE

Activity continues to accelerate with revpar up 57% vs. Q1 2022 |

Category: Worldwide - Industry economy

- Figures / Studies

This is a press release selected by our editorial committee and published online for free on Tuesday 02 May 2023

Activity continues to accelerate with REVPAR up 57% vs. Q1 2022

2023 group REVPAR outlook revised upwards with double-digit growth vs 2022

Sébastien Bazin, Chairman and Chief Executive Officer of Accor, said:

“In first-quarter 2023, Accor once again stepped-up business growth across all regions and in its two divisions: Premium, Midscale and Economy; and Luxury & Lifestyle. These excellent performances were driven in particular by the strong rebound in Asia, good price levels, and increased occupancy rates. They reflect the attractiveness of our brands, the commitment of our teams, and an ever-greater desire for travel and adventure on the part of our guests.

Given this highly positive start of the year, we have revised our 2023 guidance upwards, with double-digit RevPAR growth versus 2022."

The first quarter of 2023 demonstrated once again the robustness of the business recovery, quarter after quarter. This further acceleration in RevPAR (up 19% compared with first-quarter 2019) notably reflects the rebound of hotels in Asia following the lifting of the strict zero-COVID policy in China in late 2022. All the other regions also contributed to maintaining business activity at a substantially higher level than before the crisis.

The underlying dynamics observed in previous quarters remained in place, with average prices still high and sequentially improving occupancy rate but slightly lower than in 2019.

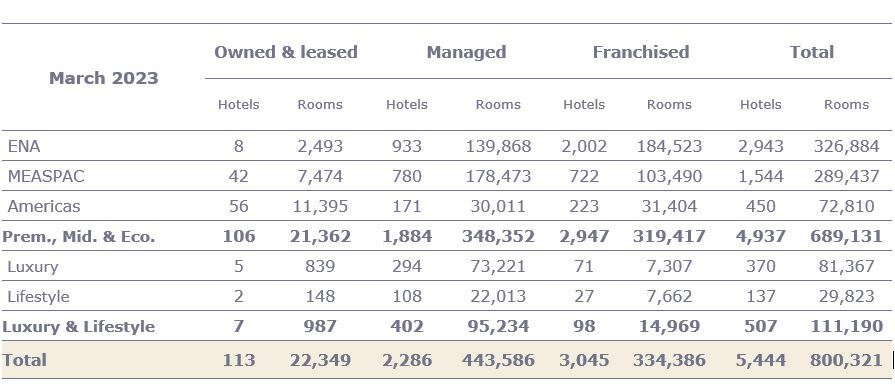

In first-quarter 2023, Accor opened 36 hotels, for around 4,400 rooms, and has thus achieved net network growth of 2.9% in the last 12 months. At end-March 2023, the Group had a hotel portfolio of 800,321 rooms (5,444 hotels) and a pipeline of around 214,000 rooms (1,241 hotels).

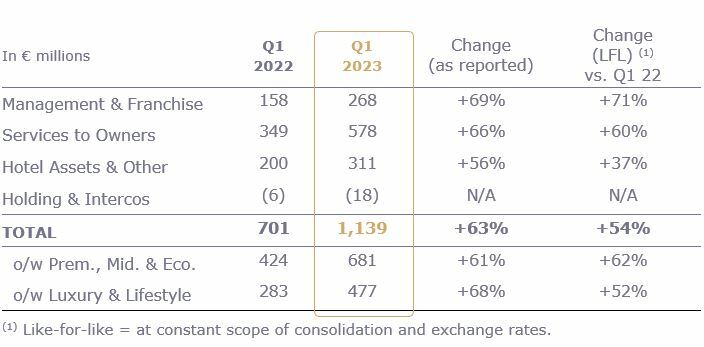

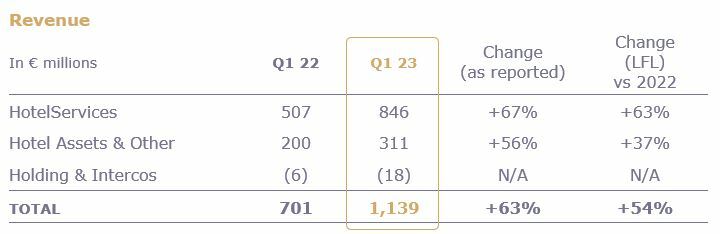

Consolidated revenue

The Group reported first-quarter 2023revenueof €1,139 million, up 54% like-for-like (LFL) versus Q1 2022. By activity, this growth breaks down into a 71% increase for Management & Franchise (M&F), a 60% increase for Services to Owners, and a 37% increase for Hotel Assets and Other.

By division (excluding Holding & Intercos), €681 million of revenue was generated by the Premium, Midscale and Economy division, up 62% LFL compared with first-quarter 2022, and €477 million by Luxury & Lifestyle, up 52% LFL.

Scope effects (acquisitions and disposals) made a positive €59 million contribution, owing primarily to the takeover of Paris Society.

Currency effects had a negative impact of €2 million, stemming mainly from the Egyptian Pound (+79%) and the Turkish Lira (+30%) offsetting the US Dollar ((5)%).

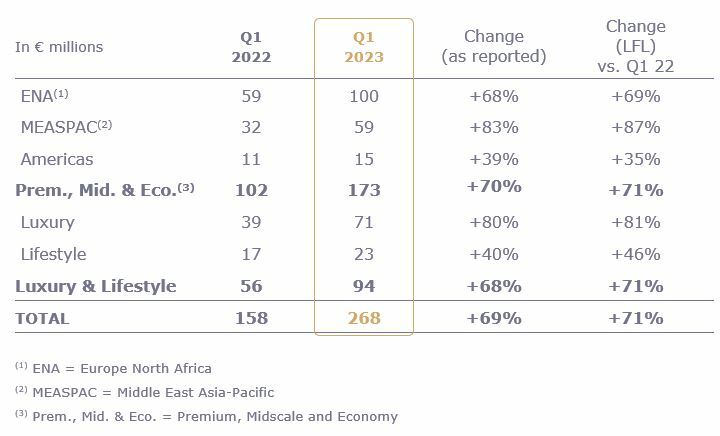

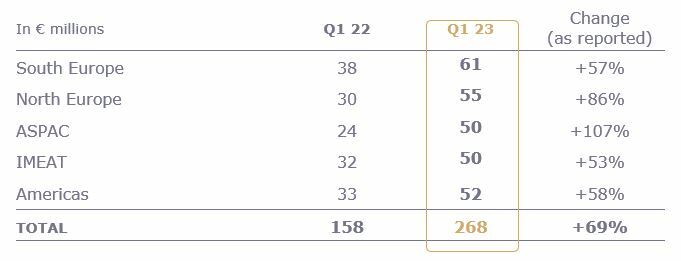

Management & Franchise (M&F) revenue

TheManagement & Franchisebusiness activity, i.e., fees collected on the basis of Management and Franchise contracts, generated revenue of €268 million, up 71% LFL compared with first-quarter 2022. The revenue of M&F grew faster than its RevPAR (up 57% from first-quarter 2022) owing to the sharp increase in the incentive fees of hotels under management contracts.

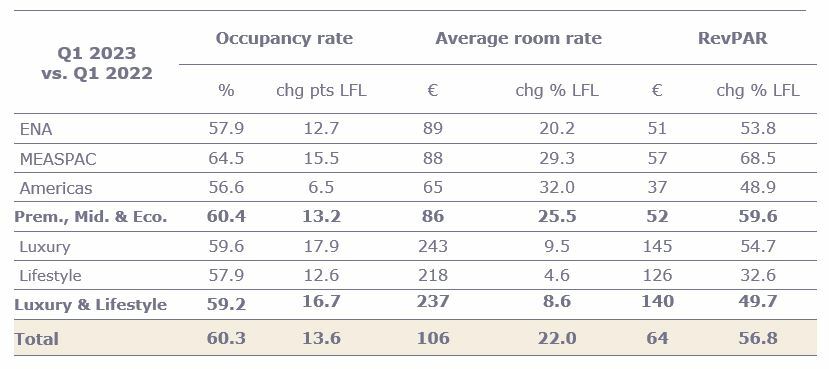

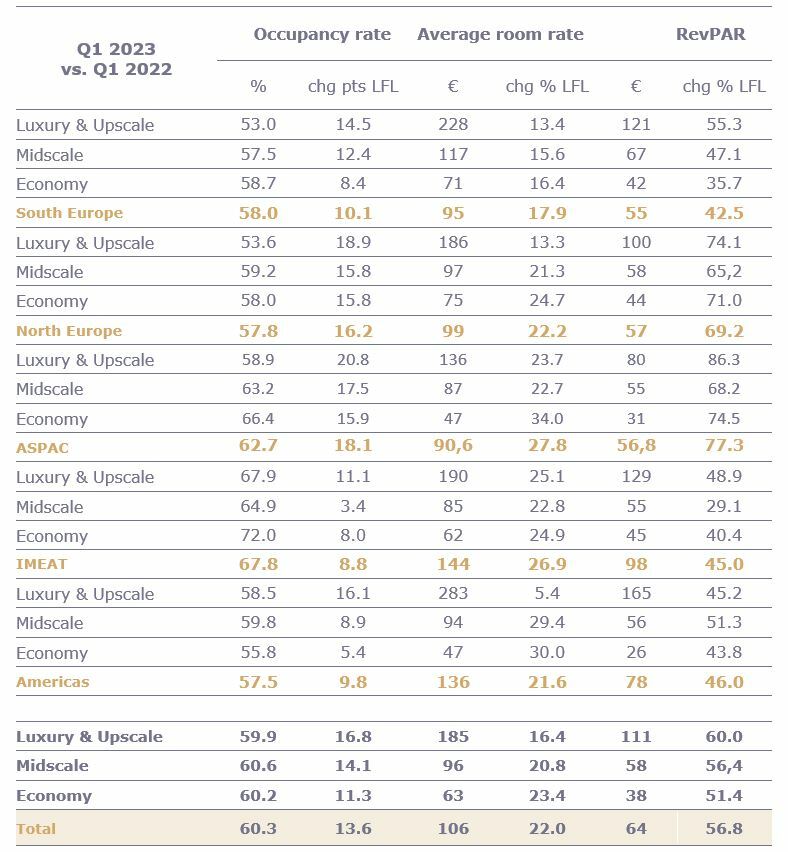

In first-quarter 2023,Consolidated RevPARcontinued its sequential rise, up 57% compared with first-quarter 2022 (and up 19% vs. first-quarter 2019).

ThePremium, Midscale and Economydivision grew its RevPAR by 60% relative to first-quarter 2022, fueled by occupancy recovery on top of continued strong pricing power.

- Europe North Africa(ENA) region reported a 54% increase in RevPAR compared with first-quarter 2022.

- RevPAR remained solid inFrance, which accounts for 46% of room revenue of the region, bolstered in particular by the return of international guests to Paris. The strikes, notably in March, did not have a significant impact.

- TheUK, 13% of room revenue of the region, achieved remarkable RevPAR growth, also thanks to the recovery of tourism in the capital.

- RevPAR inGermany, 13% of room revenue of the region, has remained deteriorated since November 2022, reflecting the seasonal nature of trade fairs and congresses. But the improvement relative to first-quarter 2022 is significant, as the country lifted its health restrictions only in April 2022.

- TheMiddle East Asia-Pacificregion reported a 69% increase in RevPAR compared with first-quarter 2022, taking advantage of the considerable rebound in activity in Asia.

- Business activity held up well overall in theMiddle East, accounting for 27% of room revenue of the region. The robust recovery in religious pilgrimages to holy cities in Saudi Arabia offset the sequential slowdown relating to the Soccer World Cup in Qatar.

- Business activity in thePacific,accounting for 28% of room revenue of the region,was comparable with the last three quarters, with powerful momentum in leisure destinations driven by prices.

- South-East Asia, accounting for 27% of room revenue of the region,benefited from the return of international travelers, notably to Thailand and Indonesia.

- Business has recovered particularly strongly inChinasince the Chinese New Year at the end of January, accounting for 18% of room revenue of the region. Considerable improvement potential remains for returning to the business levels of 2019.

- TheAmericasregion, which mainly reflects the performances of Brazil (64% of room revenue of the region) for the Premium, Midscale and Economy division, maintained solid business activity levels, with RevPAR up 49% from first-quarter 2022. With the region having returned to 2019 levels in early 2022, the base effect is less favorable.

TheLuxury & Lifestyledivision posted a 50% increase in RevPAR relative to first-quarter 2022. While price was the driving force for the recovery in 2022, occupancy increase is now pulling up the performance. As the recovery was swifter for this division than the rest of the portfolio, RevPAR growth is impacted by a less favorable base effect.

- Luxury, accounting for 78% of room revenue of the division, saw its RevPAR grow by 55% compared with first-quarter 2022. The increase was driven primarily by a year-on-year increase in the occupancy rate, but improvement potential remains in this respect as the occupancy rate remains 6 percentage points lower than in 2019.

- LifestyleRevPAR increased by 33% compared with first-quarter 2022. The weaker performance of the Lifestyle segment solely reflects a less favorable base effect as it was the segment to stage the most substantial recovery at the end of the crisis.

Services to Owners revenue

The revenue ofServices to Owners, which includes the Sales, Marketing, Distribution and Loyalty activities, as well as shared services and the repayment of hotel payroll costs, came out at €578 million in first-quarter 2023, up 60% LFL year on year. This increase was consistent with the activity level reflected in RevPAR growth.

Hotel Assets & Other revenue

Hotel Assets & Otherrevenue totalled €311 million, for a 37% LFL increase on first-quarter 2022. Strongly linked to business in Australia, this segment had benefited from the more rapid recovery of activities linked to leisure tourism demand on the country's north-east coast, home to most of the Group's Strata activities (for example, room and apartment distribution and property management). As such, the base effect was less favorable for this business segment.

As reported, the 56% increase in revenue reflects the consolidation of Paris Society business (premium restaurants and events management) since the end of 2022.

At end-March 2023, this segment, which includes owned and leased hotels, comprised 113 hotels and 22,349 rooms.

Outlook

Based on first-quarter activity and bookings for the coming months, the Group now expects double-digit RevPAR growth for 2023 vs 2022, up from its previous +5% to +9% guidance.

As part of its reorganization, Accor will organize a Capital Market Day on June 27th to provide more details on the strategy of each of its two new divisions and the expected outlook.

Events from January 1st, 2023 to April 27th, 2023

Appointment of Omer Acar

On January 3rd, 2023, Accor announced the appointment ofOmer Acaras CEO Raffles & Orient Express, effective from March 1st, 2023.

Appointment of Kamal Rhazali

On January 3rd, 2023, Accor announced the appointment of Kamal Rhazali as Secretary General and General Counsel of its Luxury & Lifestyle division, effective from February 1st, 2023

Disposal of the remaining stake in H World Group Limited (Huazhu)

On January 18th, 2023, Accor announced that it had completed the disposal of the remaining stake in H World Group Limited (previously Huazhu Group Limited) for USD460m. This transaction serves to finalize the value creation of the investment initiated in 2016. The cumulated disposal value since 2019 reaches USD1.2bn, vs. an initial investment of less than USD200m. This contributes to the asset-light strategy to simplify the Group’s balance sheet. After this transaction, Accor no longer owns any stake in H World Group Limited.

Proposed appointments to the Annual General Meeting 2023

On March 27th, 2023, Accor announced that the Board of Directors of Accor decided to submit the appointment as Director of Ms. Anne-Laure Kiechel at the next General Shareholders’ Meeting called to approve the 2022 financial statements and which will be held on May 17th, 2023.

Ms. Anne-Laure Kiechel will share with the Board of Directors her extensive knowledge of international geo-economic and financial issues. If this proposed appointment is approved by the Shareholders’ meeting, Ms. Anne-Laure Kiechel would qualify as an independent director.

The Board of Directors also decided to propose the renewal of the term of office of Mr. Sébastien Bazin, Chairman and Chief Executive Officer, Ms. Iris Knobloch, Vice-Chairman of the Board and Senior Independent Director, and Mr. Bruno Pavlovsky, Chairman of the Appointments and Compensation Committee.

Appointment of Martine Gerow

On April 12th, 2023, Accor announced that Martine Gerow has been appointed as Group Chief Finance Officer. Martine Gerow will take up her position on July 1st, 2023, tasked with overseeing the management of the Finance function for the entire Group and ensuring relations with market regulatory bodies and the financial community. She will lead the Group’s Corporate financial function and manage relations with the market regulatory authorities and financial community. She replaces Jean-Jacques Morin, former Group Deputy CEO and CFO and now Premium, Midscale & Economy Division CEO.

Martine is a graduate of HEC and holds an MBA from Columbia Business School. With a strong French and Anglo-US background, Martine started her career as a consultant with the Boston Consulting Group in New York. She then joined PepsiCo and, in 2002, moved to Danone where she served as Division CFO and Group Controller based in Paris. Martine joined the travel industry in 2014, first as CFO of Carlson Wagon Lit Travel, and, since 2017, as CFO of American Express Global Business Travel, based in London.

Upcoming events in 2023

May 17th: Annual Shareholders' Meeting

June 27th: Capital Market Day

RevPAR excluding tax per segment – Q1 2023

Hotel base – March 2023

Previous reporting format

Management & Franchise revenue per region

RevPAR excluding tax per segment – Q1 2023

About Accor

Accoris a world-leading hospitality group offering experiences across more than 110 countries in 5,400 properties, 10,000 food & beverage venues, wellness facilities and flexible workspaces. The Group has one of the industry’s most diverse hospitality ecosystems, encompassing more than 40 hotel brands from luxury to economy, as well as Lifestyle with Ennismore. Accor is committed to taking positive action in terms of business ethics & integrity, responsible tourism, sustainable development, community outreach, and diversity & inclusion. Founded in 1967, Accor SA is headquartered in France and publicly listed on Euronext Paris (ISIN: FR0000120404) and on the OTC Market (Ticker: ACCYY) in the United States.

|

|