|

IHCL ANNOUNCES FINANCIAL RESULTS FOR Q4 & FULL YEAR FY 2024-25 (India)

IHCL announces financial results for Q4 & full year FY 2024-25. |

Category: Asia Pacific - India - Industry economy

- Figures / Studies

This is a press release selected by our editorial committee and published online for free on Friday 09 May 2025

- Marks twelve consecutive quarters of record performance

- Reaches a portfolio of 380 hotels – signs 74 & opens 26 new hotels

- Proposes dividend at 20% of consolidated PAT

The Indian Hotels Company Limited (IHCL), India's largest hospitality company, reported its consolidated financials for the fourth quarter and full year ending March 31st, 2025.

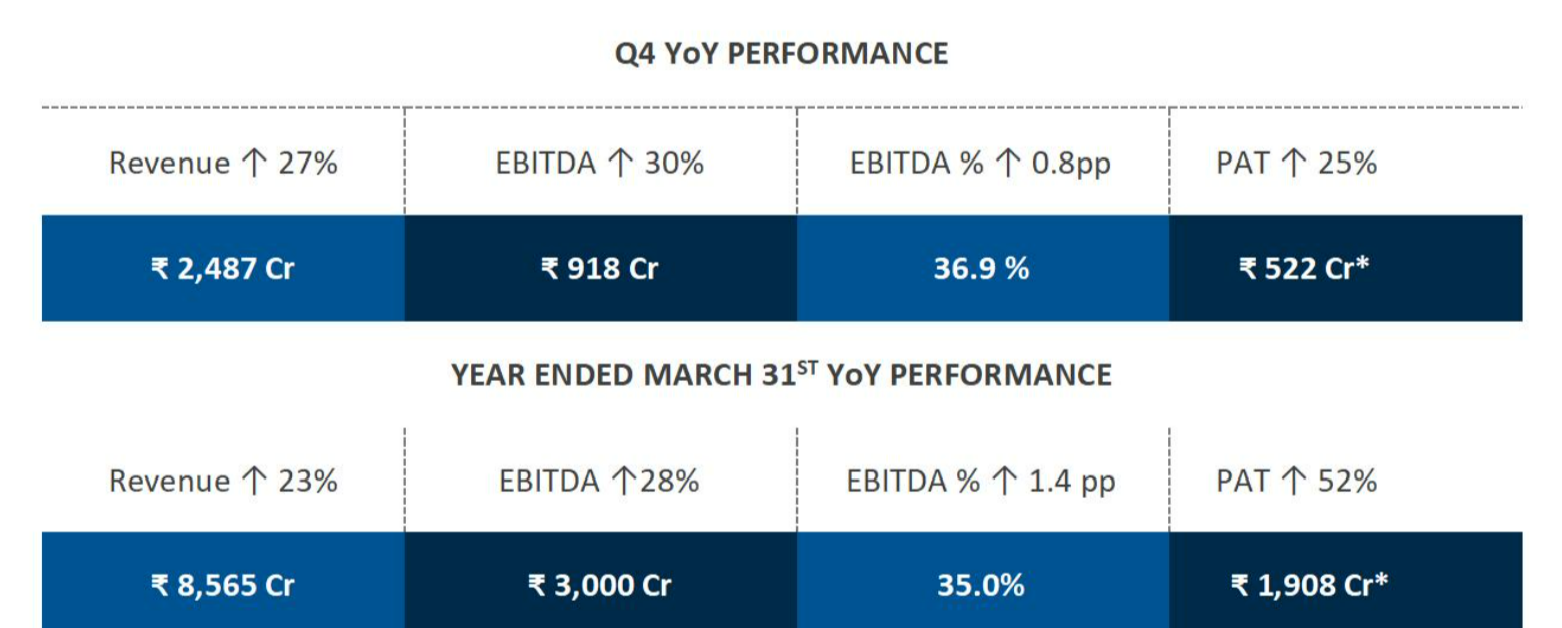

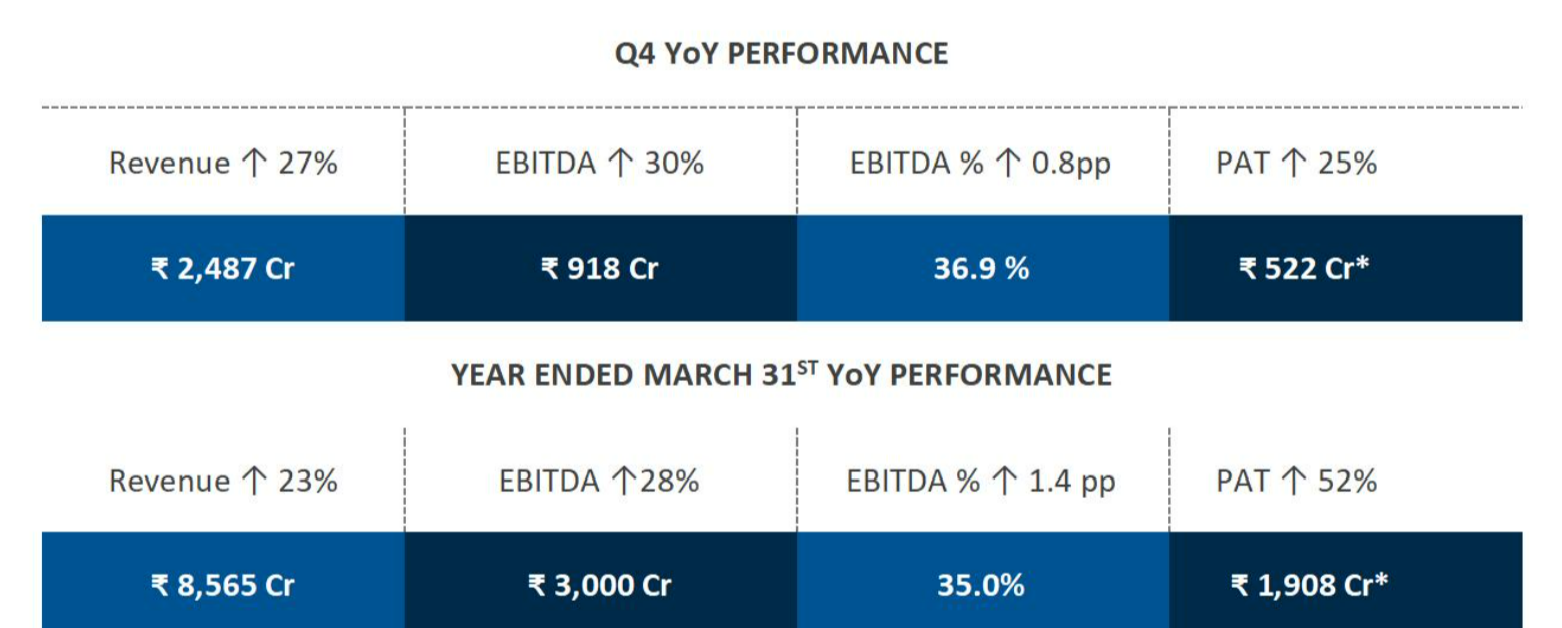

Consolidated financial results for q4 and year ended 31st March 2025

* Full year & Q4 PAT before exceptional items is INR 1,603 crores and INR 525 crores respectively. * Full year & Q4 PAT before exceptional items is INR 1,603 crores and INR 525 crores respectively.

Mr. Puneet Chhatwal, Managing Director & CEO, IHCL, said, “Q4 marks twelve consecutive quarters of record performance with consolidated hotel segment revenue reporting a strong growth of 13% resulting in EBITDA margin of 38.5%. Enterprise revenue for the full year stood at INR 14,836 crores, 1.6x of consolidated revenue, in line with our strategy of a balanced capital light and capital heavy portfolio. The consolidated double -digit revenue growth for the year was driven by strong same store performance, 40% increase in New Businesses and not like for like growth. IHCL set a new benchmark with 74 signings and 26 openings this fiscal and over 95% of these signings were capital light.”

He added, “In line with Accelerate 2030, customer centricity and operational excellence will remain at the core of our business. In FY2026, IHCL will invest over INR 1,200 crores towards the continued comprehensive asset management & upgradation program and greenfield projects with the focus on the iconic brand Taj and digital capabilities. Looking ahead at FY2026, IHCL is poised to continue double-digit revenue growth, driven by strong same-store performance, sustained momentum in New Businesses and 30 new hotel openings. The sector outlook remains strong, with demand outpacing supply, a recovery of foreign tourist arrivals and steady momentum across leisure, social and MICE segments.

Key highlights

Record financial performance

|

- Domestic same store hotels delivered a 12% Consolidated RevPAR growth with a premium of 73% vs industry at enterprise level.

- International Consolidated portfolio reported an occupancy of 73%, up 440 basis points, resulting in a RevPAR growth of 7%.

- Management Fee income grew by 20% to INR 562 crores on the back of not like for like growth.

|

New & reimagined businessses

|

- The Air & Institutional Catering business segment (TajSATS) clocked a revenue of INR 1,051 crores, 17% growth over the previous year and EBITDA margin at 25.2%. TajSATS has been Consolidated during the second quarter, resulting in INR 724 crores revenue reported as a part of IHCL Consolidated revenue in FY25.

- New Businesses vertical comprising of Ginger, Qmin, amã Stays & Trails and Tree of Life reported an Enterprise revenue of INR 802 crores, a growth of 41% and Consolidated revenue of INR 601 crores, a growth of 40%.

- Enterprise Revenue of Ginger stood at INR 675 crores with a strong EBITDAR margin at 43% with a portfolio of 103 hotels including a pipeline of 30 hotels.

- Qmin has grown to 72 outlets across multiple formats, amã Stays & Trails has reached a milestone of 301 bungalows in its portfolio with 132 in operation and Tree of Life is at a 20 resorts portfolio with 18 in operation.

|

Paathya | IHCL'S industry-leading ESG+ framework

|

|

Mr. Ankur Dalwani, Executive Vice President and Chief Financial Officer, IHCL said, “With continued demand buoyancy in the domestic market IHCL Standalone reported a full year revenue of INR 5,145 crores, an increase of 12% over the previous year, EBITDA margin of 43.9%, expansion of 260 basis points and a 29% growth in PAT at INR 1,413 crores. In FY2025, on a consolidated basis, IHCL reported revenue of INR 8,565 crores, EBITDA of INR 3,000 crores, clocking a new high EBITDA margin of 35%, an expansion of 140 bps and a PAT before exceptional items of INR 1,603 crores resulting in a strong gross cash position as on 31st March of INR 3,073 crores. Reflective of the company's sustained financial performance, a dividend of 20% of Consolidated PAT amounting to INR 2.25 per share is proposed, subject to shareholders' approval.”

He added, “IHCL has been on a journey of transformation and has demonstrated record financial performance across five fiscal years (excluding two years of the pandemic), enabled by a growth strategy of balancing capital light and capital heavy resulting in a healthy balance sheet with nil net debt and strong free cash flows.”

About The Indian Hotels Company Limited

The Indian Hotels Company Limited (IHCL) and its subsidiaries bring together a group of brands and businesses that offer a fusion of warm Indian hospitality and world-class service. These include Taj – the iconic brand for the most discerning travellers and ranked as World's Strongest Hotel Brand 2024 and India's Strongest Brand 2024 as per Brand Finance; Claridges Collection, a curated set of boutique luxury hotels merging elegance with historical charm; SeleQtions, a named collection of hotels; Tree of Life, private escapes in tranquil settings; Vivanta, sophisticated upscale hotels; Gateway, full-service hotels designed to be your gateway to exceptional destinations and Ginger, which is revolutionising the lean luxe segment.

Incorporated by the founder of the Tata Group, Jamsetji Tata, the Company opened its first hotel - The Taj Mahal Palace, in Bombay in 1903. IHCL has a portfolio of 381 hotels including 134 under development globally across 4 continents, 14 countries and in over 150+ locations. The Indian Hotels Company Limited (IHCL) is India's largest hospitality company by market capitalization. It is listed on the BSE and NSE.

|

|

* Full year & Q4 PAT before exceptional items is INR 1,603 crores and INR 525 crores respectively.

* Full year & Q4 PAT before exceptional items is INR 1,603 crores and INR 525 crores respectively.