|

WYNDHAM HOTELS & RESORTS REPORTS STRONG SECOND QUARTER RESULTS (United States)

Company raises full-year 2025 EPS outlook. |

Category: North America & West Indies / Carribean islands - United States - Industry economy

- Figures / Studies

This is a press release selected by our editorial committee and published online for free on Monday 28 July 2025

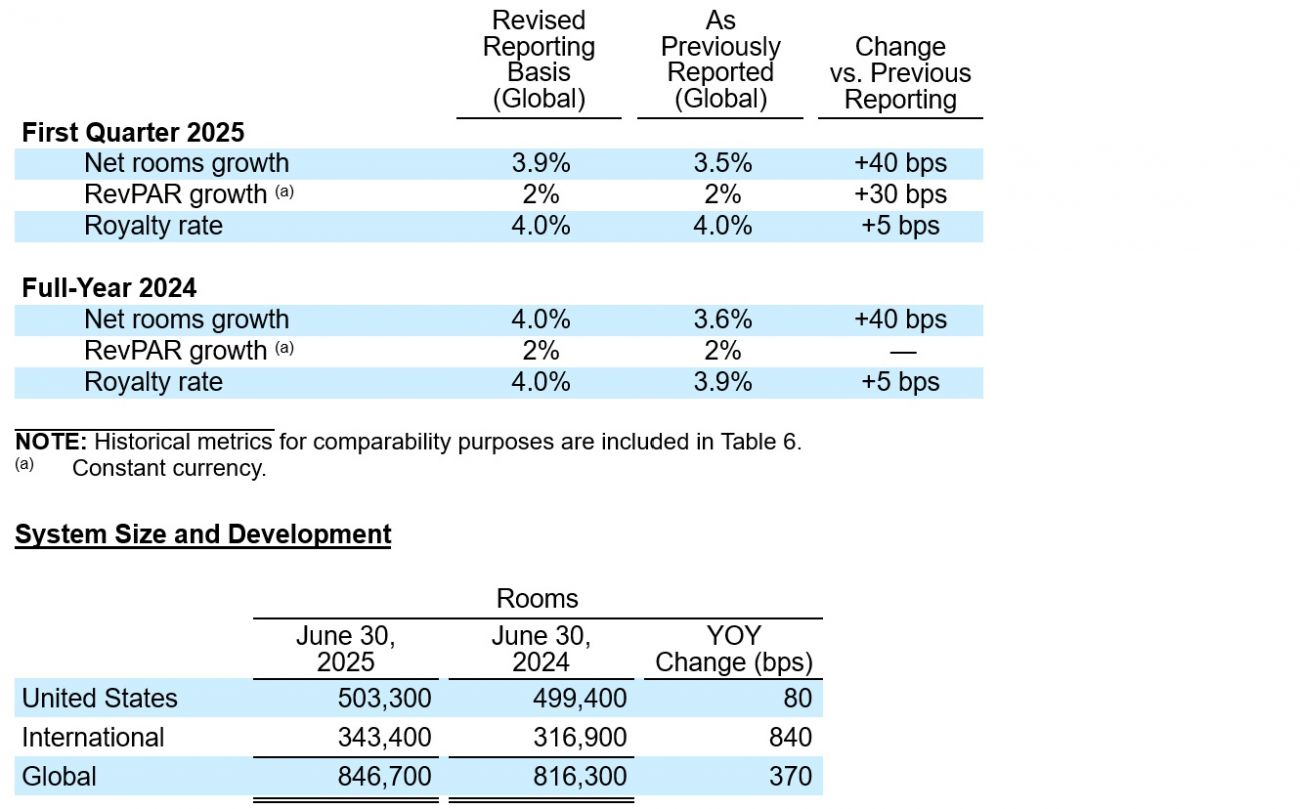

The following table reflects the impact on the Company’s global growth metrics as a result of the exclusion of its Super 8 master license agreement in China

Photo credit © Wyndham Hotel Group Highlights include: - System-wide rooms grew 4% year-over-year.

- Awarded 229 development contracts globally, an increase of 40% year-over-year.

- Development pipeline grew 1% sequentially and 5% year-over-year to a record 255,000 rooms.

- Ancillary revenues increased 19% compared to second quarter 2024 and 13% on a year-to date basis.

- Diluted earnings per share increased 6% year-over-year to $13; adjusted diluted EPS grew 18% to $1.33, or 11% on a comparable basis.

- Net income increased 1% year-over-year to $87 million; adjusted net income increased 13% to $103 million, or 7% on a comparable basis.

- Adjusted EBITDA increased 10% year-over-year to $195 million, or 5% on a comparable basis.

- Returned $109 million to shareholders through $77 million of share repurchases and quarterly cash dividends of $0.41 per share.

“We delivered another solid quarter growing our global system by 4%, expanding our development pipeline by 5%, increasing our ancillary revenues by 19%, and continuing to execute our strategy focused on higher FeePAR segments and markets, which is driving growth in both domestic and international royalty rates,” said Geoff Ballotti, president and chief executive officer.

“Record first-half openings and a 40% second quarter increase in new contracts awarded reflect strong developer confidence in Wyndham's powerful, owner-first value proposition. Amid a softer domestic RevPAR environment, we grew comparable adjusted EBITDA by 5% and comparable adjusted EPS by 11%. We also returned nearly $110 million to shareholders this quarter — continuing to demonstrate the value-creating power of our highly cash-generative, resilient asset-light business model. With consistent development, royalty rate, and ancillary fee growth, we remain very confident in our ability to create long-term value for our shareholders, franchisees, and team members through the enduring appeal of our iconic brands.”Revised International Reporting BasisAs part of a recent operational review, the Company identified violations of its Super 8 master license agreement in China and issued a notice of default to the master licensee. Given the operational challenges of obtaining accurate information from this master licensee and the uncertain outcome of the compliance process, beginning this quarter, the Company has revised its reporting methodology to exclude the impact of all rooms (approximately 67,300 rooms as of March 31, 2025) under this master license agreement from its reported system size, RevPAR and royalty rate, and corresponding growth metrics. The Company's financial results will continue to reflect fees due from the Super 8 master licensee in China, which contributed less than $3 million to the Company's full-year 2024 consolidated adjusted EBITDA.

To provide further context, the following table reflects the impact on the Company's global growth metrics as a result of the exclusion of its Super 8 master license agreement in China:

The Company's global system grew 4% including 3% growth in the higher RevPAR midscale and above segments in the U.S. and 5% growth in the higher RevPAR EMEA and Latin America regions.

On June 30, 2025, the Company's pipeline consisted of approximately 2,150 hotels and 255,000 rooms, representing another record-high level and a 5% year-over-year increase.Key highlights include: - Awarded 229 new contracts, an increase of 40% year-over-year.

- 6% pipeline growth in the U.S. and 4% growth internationally

- Approximately 70% of the pipeline is in the midscale and above segments, which grew 5% year-over-year

- Approximately 17% of the pipeline is in the extended stay segment

- Approximately 58% of the pipeline is international

- Approximately 76% of the pipeline is new construction and approximately 35% of these projects have broken ground

RevPARSecond quarter global RevPAR decreased 3% in constant currency compared to 2024, reflecting a 4% decline in the U.S. and 1% growth internationally.

In the U.S., second quarter results included approximately 150 basis points of unfavorable impacts from the timing of the Easter holiday and the 2024 solar eclipse. Excluding these impacts, the Company's U.S. RevPAR declined approximately 2.3% year-over-year, driven by softer demand, partially offset by a modest increase in pricing.

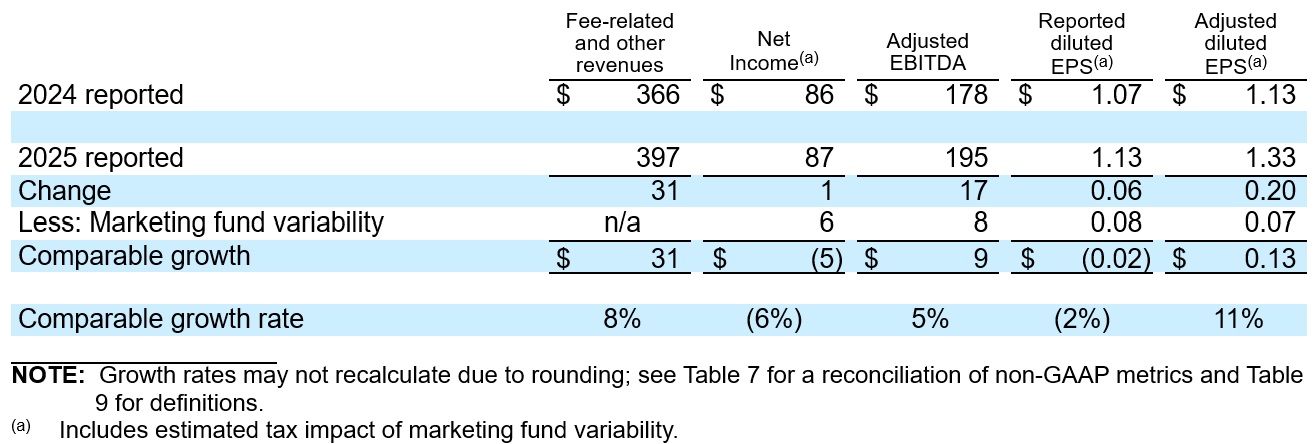

Internationally, RevPAR results were driven by continued pricing power, offset by a decline in occupancy. The Company continued to see strong performance in its EMEA and Latin America regions, with year-over-year growth of 7% and 18%, respectively, reflecting robust pricing power in both regions. The Company's Canada region grew RevPAR by 7% reflecting increased room nights from Canadian guests. In China, RevPAR decreased 8% year-over-year reflecting a decline in occupancy and continued pricing pressure.Second Quarter Operating ResultsThe comparability of the Company's second quarter results is impacted by marketing fund variability.

The Company's reported results and comparable-basis results (adjusted to neutralize these impacts) are presented below to enhance transparency and provide a better understanding of the results of the Company's ongoing operations. - Fee-related and other revenues grew 8% to $397 million compared to $366 million in second quarter 2024, which reflects a 19% increase in ancillary revenues, higher royalties and franchise fees, as well as higher pass-through revenues due to the Company's global franchisee conference in May.

- The Company generated net income of $87 million, a 1% increase compared to second quarter 2024, as higher adjusted EBITDA and lower transaction-related expenses were partially offset by the absence of a benefit in connection with the reversal of a spin-off related matter, higher restructuring costs, and increased interest expense. Adjusted net income grew 13% to $103 million compared to $91 million in second quarter 2024.

- Adjusted EBITDA grew 10% to $195 million compared to $178million in second quarter 2024. This increase included an $8 million favorable impact from marketing fund variability, excluding which adjusted EBITDA grew 5% on a comparable basis, primarily reflecting increased ancillary revenues, as well as higher royalties and franchise fees, partially offset by higher operating expenses primarily related to growth in the Company's credit card program and the absence of a benefit from insurance recoveries.

- Diluted earnings per share increased 6% to $13 compared to $1.07 in second quarter 2024. This increase primarily reflects the benefit of a lower share count due to share repurchase activity.

- Adjusted diluted EPS grew 18% to $1.33 compared to $1.13 in second quarter 2024. This increase included a favorable impact of $0.07 per share related to marketing fund variability (after estimated taxes). On a comparable basis, adjusted diluted EPS increased approximately 11% year-over-year, reflecting comparable adjusted EBITDA growth, the benefit of share repurchase activity and lower depreciation and amortization, partially offset by higher interest expense.

- During second quarter 2025, the Company's marketing fund revenues exceeded expenses by $3 million; while in second quarter 2024, the Company's marketing fund expenses exceeded revenues by $5 million, resulting in $8 million of marketing fund variability.

Full reconciliations of GAAP results to the Company's non-GAAP adjusted measures for all reported periods appear in the tables to this press release.Balance Sheet and LiquidityThe Company generated $70 million of net cash provided by operating activities and $88 million of adjusted free cash flow in second quarter 2025. The Company ended the quarter with a cash balance of $50 million and approximately $580 million in total liquidity.

The Company's net debt leverage ratio was 3.5 times at June 30, 2025, the midpoint of the Company's 3 to 4 times stated target range and in line with expectations.Share Repurchases and DividendsDuring the second quarter, the Company repurchased approximately 923,000 shares of its common stock for $77 million.

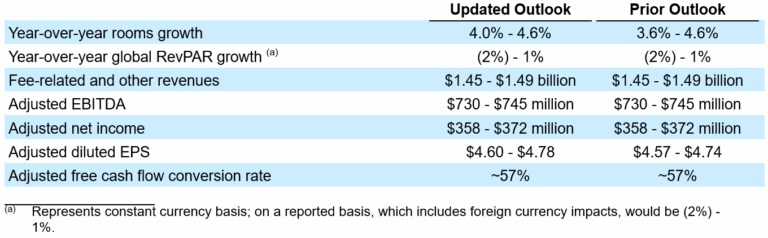

The Company paid common stock dividends of $32 million, or $0.41 per share, during the second quarter 2025.Full-Year 2025 OutlookThe Company is increasing its adjusted diluted EPS outlook to reflect the impact of second quarter share repurchase activity and increasing the low-end of its year-over-year rooms growth outlook by 40 basis points to reflect the removal of the dilutive impact from its Super 8 master licensee in China.

The Company continues to expect marketing fund revenues to approximate expenses during full-year 2025 though seasonality of spend will affect the quarterly comparisons throughout the year.

More detailed projections are available in Table 8 of this press release. The Company is providing certain financial metrics only on a non-GAAP basis because, without unreasonable efforts, it is unable to predict with reasonable certainty the occurrence or amount of all of the adjustments or other potential adjustments that may arise in the future during the forward-looking period, which can be dependent on future events that may not be reliably predicted. Based on past reported results, where one or more of these items have been applicable, such excluded items could be material, individually or in the aggregate, to the reported results.Conference Call InformationWyndham Hotels will hold a conference call with investors to discuss the Company's results and outlook on Thursday, July 24, 2025 at 8:30 a.m. ET. Listeners can access the webcast live through the Company's website at https://investor.wyndhamhotels.com. The conference call may also be accessed by dialing 800 343-4136 and providing the passcode “Wyndham”. Listeners are urged to call at least five minutes prior to the scheduled start time. An archive of this webcast will be available on the website beginning at noon ET on July 24, 2025. A telephone replay will be available for approximately ten days beginning at noon ET on July 24, 2025 at 800 723-8184.About Wyndham Hotels & ResortsWyndham Hotels & Resorts (NYSE: WH) is the world's largest hotel franchising company by the number of franchised properties, with approximately 8,300 hotels across approximately 100 countries on six continents. Through its network of approximately 847,000 rooms appealing to the everyday traveler, Wyndham commands a leading presence in the economy and midscale segments of the lodging industry. The Company operates a portfolio of 25 hotel brands, including Super 8, Days Inn, Ramada, Microtel, La Quinta, Baymont, Wingate, AmericInn, ECHO Suites, Registry Collection Hotels, Trademark Collection and Wyndham. The Company's award-winning Wyndham Rewards loyalty program offers approximately 120 million enrolled members the opportunity to redeem points at thousands of hotels, vacation club resorts and vacation rentals globally.

The Company may use its website and social media channels as means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD. Disclosures of this nature will be included on the Company's website in the Investors section, which can currently be accessed at https://investor.wyndhamhotels.com or on the Company's social media channels, including the Company's LinkedIn account which can currently be accessed at https://www.linkedin.com/company/wyndhamhotels. Accordingly, investors should monitor this section of the Company's website and the Company's social media channels in addition to following the Company's press releases, filings submitted with the Securities and Exchange Commission and any public conference calls or webcasts.

RevPAR

Photo credit © Wyndham Hotel Group

Second Quarter Operating Results

Photo credit © Wyndham Hotel Group

|

|