|

HILTON REPORTS SECOND QUARTER RESULTS (États-Unis)

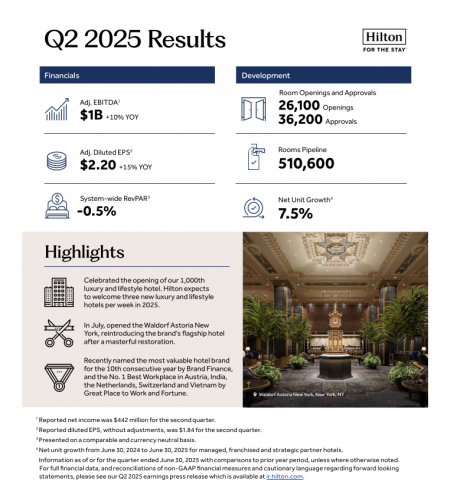

Hilton Worldwide Holdings Inc. ("Hilton," "the Company," "we," "us" or "our") (NYSE: HLT) today reported its second quarter 2025 results. |

Catégorie : Amérique du Nord et Antilles - États-Unis - Économie du secteur

- Chiffres et études

Ceci est un communiqué de presse sélectionné par notre comité éditorial et publié gratuitement le jeudi 24 juillet 2025

Crédit photo © Hilton Worldwide Highlights include:

- Diluted EPS was $1.84 for the second quarter, and diluted EPS, adjusted for special items, was $2.20

- Net income was $442 million for the second quarter

- Adjusted EBITDA was $1,008 million for the second quarter

- System-wide comparable RevPAR declined 0.5 percent, on a currency neutral basis, for the second quarter compared to the same period in 2024

- Approved 36,200 new rooms for development during the second quarter, bringing our development pipeline to a record 510,600 rooms as of June 30, 2025, up 4 percent compared to June 30, 2024 excluding the impact of acquisitions and strategic partner hotels

- Added 26,100 rooms to our system, resulting in 22,600 net additional rooms for the second quarter, contributing to net unit growth of 7.5 percent from June 30, 2024

- Issued $1.0 billion aggregate principal amount of 5.750% Senior Notes due 2033 in July 2025 (the "July Senior Notes issuance")

- Repurchased 3.2 million shares of Hilton common stock during the second quarter; bringing total capital return, including dividends, to $791 million for the quarter and $1,881 million year to date through July

- Full year 2025 system-wide RevPAR is projected to be flat to an increase of 2.0 percent on a comparable and currency neutral basis compared to 2024; full year net income is projected to be between $1,640 million and $1,682 million; full year Adjusted EBITDA is projected to be between $3,650 million and $3,710 million

- Full year 2025 capital return is projected to be approximately $3.3 billion

Christopher J. Nassetta, President & Chief Executive Officer of Hilton, said, "We continued to demonstrate the power of our resilient business model as we delivered strong bottom line results in the quarter, even with modestly negative top line performance given holiday and calendar shifts, reduced government spending, softer international inbound business and broader economic uncertainty. With that being said, we believe the economy in our largest market is set up for better growth over the intermediate term, which should accelerate travel demand and, when paired with low industry supply growth, unlock stronger RevPAR growth. On the development side, we achieved the largest pipeline in our history, and we remain confident in our ability to deliver net unit growth between 6.0 percent and 7.0 percent for the next several years."

For the three months ended June 30, 2025, system-wide comparable RevPAR decreased 0.5 percent compared to the same period in 2024 due to modest occupancy declines, partially mitigated by ADR gains. Management and franchise fee revenues increased 7.9 percent compared to the same period in 2024.

For the six months ended June 30, 2025, system-wide comparable RevPAR increased 1.0 percent compared to the same period in 2024 due to an increase in ADR. Management and franchise fee revenues increased 6.6 percent compared to the same period in 2024.

For the three months ended June 30, 2025, diluted EPS was $1.84 and diluted EPS, adjusted for special items, was $2.20, compared to $1.67 and $1.91, respectively, for the three months ended June 30, 2024. Net income and Adjusted EBITDA were $442 million and $1,008 million, respectively, for the three months ended June 30, 2025, compared to $422 million and $917 million, respectively, for the three months ended June 30, 2024.

|

|